By: Sigmund Ausfresser

Hello everyone, and welcome to my new home. After over three years of writing for other MTG Finance websites, I’m delighted to reach a broader audience here at MTGPrice.com. The opportunity is truly energizing, and I look forward to engaging dialogues each and every week. To that end, I encourage you to please share your thoughts – both positive and negative – in the comments section whenever you’d like.

Before I jump into my financial content for today, I wanted to first share a brief overview of my background. This context will really foreshadow many of my future topics, underlining my general approach to MTG Finance. Allow me to explain.

Background and Motivation

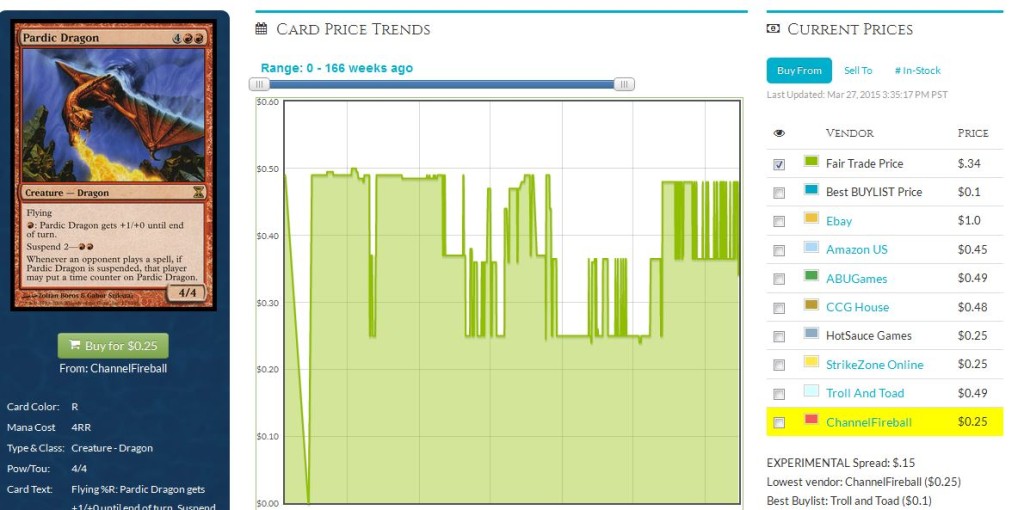

Technically, I’ve been playing Magic for about 18 years now…well, if you consider casting numerous Craw Wurms and Dark Banishings “Magic”. For over a decade I was solely a casual player; never understanding the allure of tournaments or adhering to certain rules dictated by various formats. Finally around Time Spiral block I dipped my toe into the competitive waters. I couldn’t understand why a card like Strangling Soot was so good, and why my first picking of Pardic Dragon wasn’t winning me games. It was the rare, after all!

My defeats were swift and merciless. Clearly, there was much to learn.

A couple years later I was introduced to the concept of MTG Finance at my local card shop by a couple of influential members of the community. I distinctly remember asking the question that changed my perceptions of MTG Finance forever.

Me: “How did you get all of these valuable cards? Do you just open a lot of packs?”

Him: “Through trades.”

ADVERTISEMENT:

My paradigm of Magic was changed forever. I had finally realized the power of knowing not only the value of my cards but the value of others’ cards as well. I also discovered that cards had wildly fluctuating prices, which lent themselves to opportunistic exchanges and investments. Needless to say, I was immediately hooked. My soul purpose for attending local events suddenly became about trading, not battling. The methodology was easy to pick up, I signed up for a Twitter account to follow other MTG Finance experts, and the rest is history.

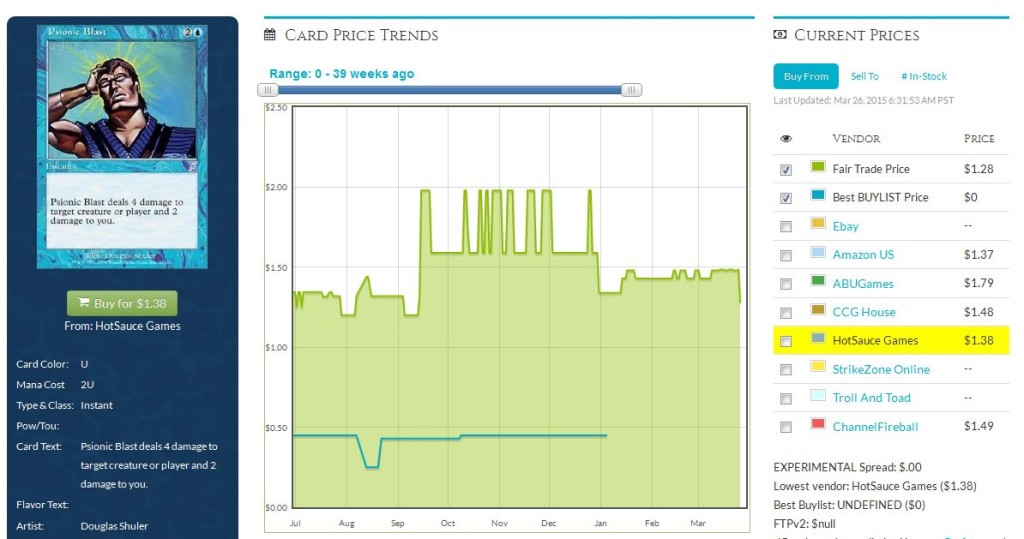

What’s left out of the story above, however, is my primary motivation. At first my goal was simply to avoid losing/spending money to play Magic. I learned a very difficult lesson after Psionic Blast went from $25 to under $5 after Time Spiral block rotated out of Standard. I had no idea rotation was a thing, and I certainly regretted giving up so much value for the under-appreciated Blue instant.

After these unfortunate trades, I swore I would pay much closer attention to financial trends. Fool me once, shame on you. Fool me twice, shame on me.

Through frantic research and continuous education, I learned how to not only avoid pitfalls such as these, but also how to trade into cards with potential appreciation. A cautious approach was my friend, ensuring I didn’t move into any cards too rashly.

About a year later my spouse gave birth to our son, and my priorities changed dramatically. Finding inspiration from a kind gesture from another member of the Magic community, I decided I’d refocus my efforts in MTG Finance with a new goal: to make money from the game so as to offset or cover college costs for my son. Three years later I can confidently say I’ve made a small dent in the projected cost of his education, but I know I have a ways to go.

Risks and Rewards

This new-found motivation to pursue MTG Finance segues nicely to my financial topic for this week: risk. Everyone manages risk differently and in an uncontrolled, often manipulated market there is a full continuum of risk/reward strategies one could pursue. We’re talking extreme opportunities here. Ranging from buying one case of every new set to sit on for ten years (on the conservative end) to buying 1,000 copies of a seemingly bulk rare such as Amulet of Vigor, only to see a 1200% return over an 18 month time period.

I often hear about how difficult it is for even the most adept hedge fund managers to beat the S&P 500 on a consistent basis. If only they heard about MTG Finance!

The reason I bring up this risk continuum is because I share where my strategy lies, for context. Generally I am a risk-averse person. I also have a lingering fear of MTG Finance in general – the secondary Magic Card market is easily manipulated and unregulated, controlled only by Hasbro’s whim. Therefore I make a point not to overextend my exposure to MTG. Everyone has their financial flexibility and limitations, and I’m comfortable with my allocation to investments in this game.

Additionally, I strive to keep my goal in focus. If I truly hope to put a dent in my son’s college education costs 15 years from now, I can’t go around taking dramatic risk. The reward potential may be large, but losing significant money in this game could set me back years. Therefore, I focus on a strategy of diversification. I try my best to allocate capital towards an array of targets, including cards from Vintage, Legacy, Modern, Standard, Commander as well as sealed product. This way if any format were to suddenly drop in popularity or shift dramatically I wouldn’t lose too much at once. It’s a strategy I borrow from Wall Street investing and it has worked well for me thus far.

A New Risk

In the past few years, Wizards of the Coast has dramatically increased their tendency to do something potentially detrimental to MTG collection values everywhere. Know what it is? Here’s a hint:

Wizards of the Coast has decided to tap into the powerful secondary market by creating more and more products with reprints. Can you really blame them? Duel Decks, Event Decks, Commander products, From the Vault series, more and more judge promos, Modern Masters, and all these old set rehashes (e.g. Return to Ravnica, Scars of Mirrodin, and Battle for Zendikar) – every single one has given Wizards of the Coast an opportunity to increase sales by bringing back strategic valuable cards from old sets. And while the reprint is nothing new, their frequency is surely alarming to a conservative speculator such as me.

How do I manage this new risk? Besides diversification, I’m a strong believer that certain cards are more prone to reprint risk than others. My strategy is to identify the lower risk cards which see plenty of play and move in accordingly. This goes beyond sticking with newer cards cleared from MM2015 such as Snapcaster Mage, mind you. While Snapcaster was a terrific buy a couple months ago, I think there are some other less obvious pickups which should be relatively safe from reprinting.

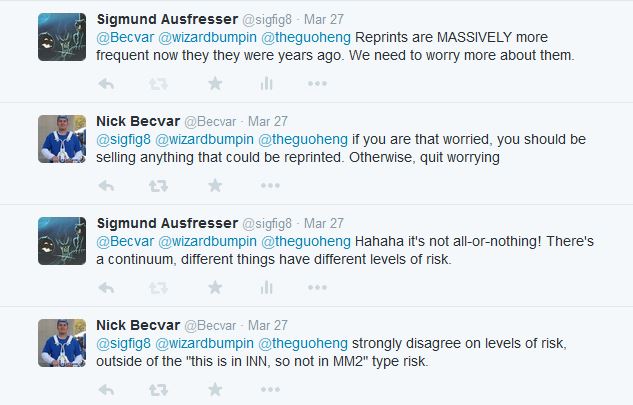

I should point out that not everyone agrees with this sentiment. A recent Twitter conversation was the first time I recognized the dissonance in community opinion.

I have complete respect for Nick, but my opinion was not influenced by Twitter debate. Since I have more than 140 characters to work with, I’m hoping I can share my perspective here.

Let’s start with a premise: Wizards of the Coast does not want Modern Masters 2015 to be too much like Modern Masters. If there’s mostly overlap between sets, the new product won’t have a new “feel” to it. Players wouldn’t like this. Additionally, the new Modern Masters 2015 set will have a broader menu of sets to include reprints from. The first MMA set contained cards ranging from Eighth Edition through Alara Reborn. Yet MM2015 will contain cards all the way up through and including New Phyrexia. The larger pool of cards dictates most the MMA cards cannot reappear in MM2015.

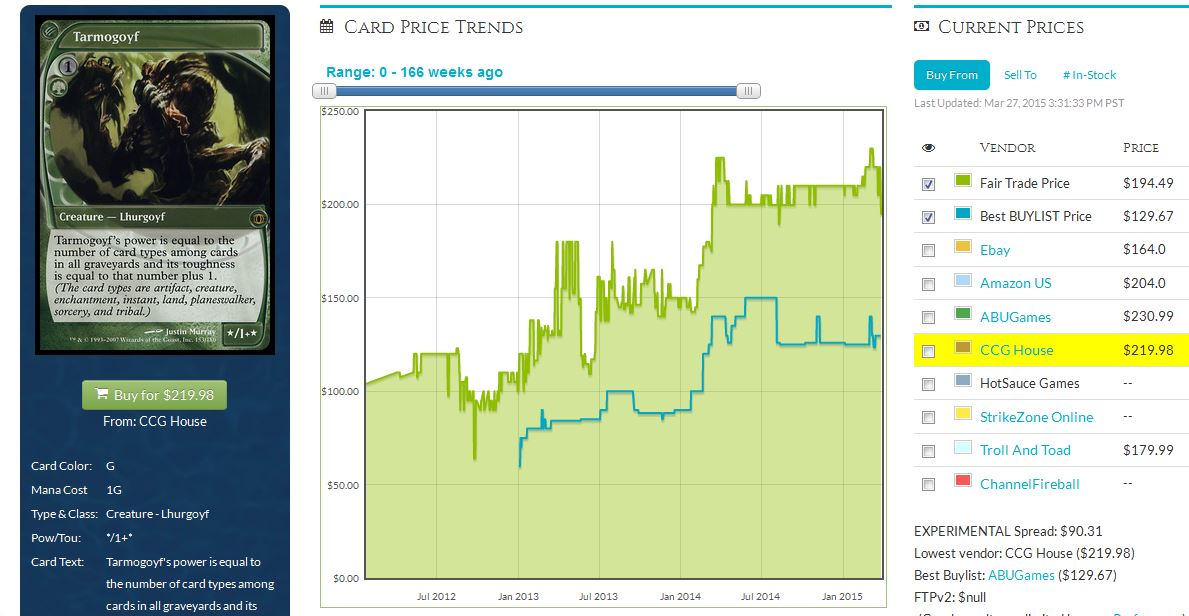

“But but…what about Tarmogoyf? We already know he’s back again!”

While true, let’s look at this with a little pragmatism here. Tarmogoyf continues to be the most expensive card in Modern despite getting the reprint treatment in the first Modern Masters. In fact, the value of the Green creature went UP upon reprinting. This means two things for WOTC. First, they have license to reprint this card again knowing another printing at Mythic Rare won’t absolutely destroy Tarmogoyf’s market value. And second, they would be crazy not to include him in the new Modern Mastsers set. That card alone is going to sell the set. Suddenly paying $9.99 for a pack is less worrisome when you know you can open up $200 in a single card.

So while there will likely be a few other strategic reappearances, I still think this set will be designed to have a different “feel”. New mechanics will appear (e.g. annihilator, metalcraft) and Wizards will need to print sufficient cards to support those strategies in draft. There are also a good deal of valuable cards in the newer sets of MM2015, and these cannot be ignored.

With all this said, I stand by my tweets above: some cards are less risky than others.

For example, Pact of Negation, Slaughter Pact, and Summoners’ Pact got the reprint treatment in MMA. I don’t anticipate they’ll show up again. That would be three repeat slots taken up, and I just don’t think they’ll come back. There were also only fifteen Mythic Rares in MMA. We already know Goyf is coming back as one for MM2015. How many repeat Mythics will show up? With a bunch of Eldrazi, Mox Opal, and a few other expensive, newer cards to reprint I can’t imagine we see too much overlap in the Mythic Rare department. Vedalken Shackles still hasn’t recovered fully from its reprinting and is unlikely to come back. Or how about the two swords we got in MMA? Wouldn’t it make more sense to see two of the newer swords in MM2015, such as Sword of War and Peace and Sword of Feast and Famine?

And forget the Dragon Spirit cycle – that’s five relatively cheap Mythic Rares no one wants to open in a $10 pack.

Net, I don’t only believe some cards are more reprintable than others. I believe we can strategically mitigate risk to our portfolios by anticipating which cards are unlikely to show up for a second go around. I doubt I’ll predict things perfectly, but if I can use any information available to me to avoid taking unnecessary losses on cards, you’d better believe I’m going to do so. Often times, that’s what the name of the game is – using information available to us as best as we can to try and create an edge.

It’s that edge that leads to sustainable, consistent profits. It also adds discipline to our approach, ensuring we think through our investment decisions before committing funds. And in a world of rampant buy-outs and needless hype, strategic thinking is even more critical in order to avoid pitfalls of baseless speculation.

Wrapping It Up

Hopefully my introductory article here on MTGPrice covered the backdrop for how I approach MTG Finance, while also hinting at some worthwhile targets in trade. Something like Pact of Negation is unfortunately already $20+, but it’s also the only played free Counterspell in Modern. It also sees occasional Legacy play, which makes the card even more attractive for the long run. And with its appearance in the first Modern Masters, you could do worse than to trade into a few copies if you’re looking for slow, stable upside.

Other safer targets include Engineered Explosives (my number one Tiny Leaders target), Glen Elendra Archmage, and Lotus Bloom.

In the future I hope to look beyond Modern and share some of my favorite targets in other formats, along with how I’m currently allocating my funds toward each format. I’ll explain why I think Dual Lands have pulled back significantly over the past few months, and why I see that trend reversing very soon. I’ll share the economic theory behind rising prices in the Vintage market. And I’ll share my misadventures in the sealed product space.

With so much to discuss, along with a backdrop of an ever-changing environment of buyouts and new sets, I hope to be writing for MTGPrice for years to come. I look forward to each and every week.

…

Sig’s Quick Hits

Each week, in addition to my actual article, I like to share three interesting tidbits worth noting based on Star City Games’ stock. The information is shared in rapid fire fashion, and the reader is left to interpret the implications and act in the way they deem best. I hope to continue this practice here at MTGPrice.com, and I’d appreciate comments from readers as to whether or not this section is well-received.

- As long as Affinity remains popular in Modern, Stony Silence will be a worthwhile card to acquire. And with the likely inclusion of metalcraft in MM2015, perhaps the interest in this archetype will increase even further. Star City Games currently has just 3 copies in stock, with a price tag of $4.45.

- Why do I think at least some Dual Lands have finally bottomed? Well Volcanic Island’s stock at Star City Games has continued to dwindle. They now have just 13 total Revised copies in stock, with NM copies listed at $299.99. After dominating the Dual Land world for decades, Underground Sea may finally lose its status as “most expensive Dual Land”. It too retails for $299.99 but SCG has 45 total copies in stock, although none are NM.

- Foil Command Towers are still tough to come by. Star City Games is still only charging $29.99 for both Commander’s Arsenal and judge promo copies. Though, it’s worth mentioning they are sold out of each. I suspect they increase their prices when they restock.

Hey, that was a great start. If you keep writing, I will keep reading!!

I am more risk averse than others, having less disposable cash (i have a son also – there goes the bankroll). While I am not a mtgfinance guru, I just want to make the money I put in go further, and be able to build whatever I want without having to put out heaps of money. So i like to pick up staples i think are cheap, hold them, and if i can sell them I will. I only play modern because with a son, getting once a week magic for 6-12 months out of a single expensive standard deck doesnt do much for me.

Your topic hits close to the core. Slower solid growth is more consistent than going for the quick hit. examples of quick hits that might or might not pan out:

a) collected company, esp foils

b) monastery siege – once again the foils seem low. the power level of this card in Merfolk is quite amazing. Hopefully it pushes abrupt decay up!

c) outpost siege – the better version of Chandra pyromaster, being very difficult to beat. Jund is making a comeback.

This is the type of stuff I try to avoid – really an all in proposition

What are your thoughts on damnation? As i see it, the judge promo has only 3 possible effects in relation to MM15: it either makes it more likely, less likely or irrelevant. I think we can cancel more likely, as that is not logical. So it is either irrelevant or less likely in my mind. There is significant downside if it gets reprinted, but probably a $20 bet either way. unfortunately being a $45 card to begin with makes that not really smart.

Chalice of the void seems a bad pickup given the artifact theme of mm2.

Dark Confidant – reprint or not? I am holding off pulling the trigger on this, but on second thoughts, there is next to no chance they print it at rare. If confidant is not reprinted, and jund continues to do well (putting up as many results as abzan), this has the potential to be the third $100 card, after liliana.

Something I think they are not going to reprint for a while is the filterlands. They surely cannot put the whole 10 lands in MM15, and with zendikar upcoming, it is going to be a while before they come good. I like sunken ruins because of the possibilities the printing of polluted delta brought with it (sultai control as an archetype is great). potentially flooded grove as well. Being $20 means they wont really be hammered that badly if they are reprinted in standard if that occurs. Am I way off here?

this has just turned into a disorganised rant. sorry for that. Thanks for writing the article, thought provoking

Josh,

Thank you very much for the kind words and the warm welcome! It’s really an honor to have this opportunity to reach a broader audience with my writing. I sincerely hope others respond in the same way as you did – I feel like there are a ton of “full timers” out there who grind out event after event, have liquidity to buy up 100’s of copies of a card at a given time, and have the time to micromanage a large, diverse collection. I generally don’t have the time and I don’t allow myself the resources for this kind of practice. So I’m right there with you – I’d much rather have slow and steady growth with high likelihood vs. chances to double up quickly and severe downside risk.

You’ve listed some puzzling ones indeed, and I’ll admit I don’t have all the answers. I’ve heard most people say a Damnation reprint is unlikely in MM2015 after the promo’s printing. I can get on board with that, but I do suspect a reprint will happen eventually. If you will truly enjoy/benefit from having copies then get them now and enjoy! But if you are trying to maximize value, there are better buys elsewhere…especially at that $45 price point!

I’m avoiding Dark Confidant. I think it can easily reappear in MM2015, but that’s just my hunch. I agree Chalice is also an “avoid”, if anything just because it recently shot up and it feels kind of expensive for its utility.

You’re right they may not reprint 10 filter lands, but I could certainly see them reprinting a strategic few. Think about it – they reprinted cards that were part of a cycle but not the whole cycle in MMA, so why not reprint only the more expensive Filter lands? Just a theory…I really have no good argument beyond that. But no one really NEEDS filter lands to play Modern anyway, so I’d say avoid. Put the money into Shocks…I think there’s more upside there and we KNOW they won’t be in MM2015.

I should have articles going up every week, so stay tuned. Hopefully they will strike close to home for you since we seem to have a similar view on how to approach MTG Finance. Especially the part about balancing fatherhood and Magic – no small feat!!!

Thanks again for the kind comments, and look forward to continuing dialogue in forums or on Twitter!

Sig

Welcome to the family! I always love when people want to talk risk management. 🙂

Lol thanks for the warm welcome! I look forward to working more with you. Risk/reward is a balance I focus on quite a bit when dealing in MTG Finance (and in the stock market for that matter). Find the opportunity with high upside and low risk, and you’ve got an investment worth making! They’re out there – we just have to sort through the noise to find it.

Thanks for commenting. See you in the forums!

Sig

Your motivations to get into MTG Finance mirror my own. I also pretty much only play on pre-release weekends to get a feel of the new sets. The rest of the time is spent building a small nest egg for my newborn when she gets older.

Mike,

That’s awesome to hear! Glad I’m not the only one undertaking this arduous quest. :-). It’s not been easy, but if we work together as a community I think we can all benefit by sharing our strategies and investment ideas.

I don’t get out for pre-releases all that much – they’re too much of a time commitment. Usually I keep 1 Modern deck and 1 Legacy deck. Since they won’t rotate ever, I don’t mind sinking a little money into them since there is upside potential through gradual growth. That’s the major reason I dodge Standard altogether. Too costly to keep up with!

Thanks for commenting. Look forward to connecting in the future!

Sig

I remember being a happy panda when i read your articles on QuietSpec one year ago, you have an incredible positive attitude and an excelent aproach to the risk side and many other aspects of some of the more interesting MTGFinance topics.

I always try to think about the worst case scenario when i buy some cards or a collection, how many dollars can i make? how much time do i have? is there better places to put my money? is the card going to be reprinted soon? those questions can be an excellents ways to make a buying decision.

But well, i learned so much from you in twitter, quietspec and even Facebook (that time when i tried to sell your mox and we talked lather about Jaya Ballards and your collections of angels was a really nice conversation) so i am so happy to see you here.

Keep the good work Sig and continue to be an awesome member of this community.

Alexis,

Thanks so much for the words of praise! They really mean a lot, as I take my writing positions very seriously and do my very best to provide insightful and entertaining articles each week. (Surely any discussion around my ridiculous Jaya Ballard collection are entertaining to some…sad extent). 😛

Thanks for following me here and for leaving your comment. I look forward to talking more in the future! Especially when it comes to risk/reward equations – it’s a topic near and dear to my heart!

Sig

Would be interested in hearing your thoughts on MMA2 risks considering dealers are already preselling boxes north of $300. The heightened cost at opening helps to stabilize nominal value of the product. I.e. if it costs as much now to pack out a Goyf while still not satisfying the demand for it then his price should neither up or down. I don’t believe my assessment of this is wrong. Inflated entry cost stabilizes existing value.

Tom,

You bring up a very valid point. The higher MSRP cost of MM2015 is definitely going to limit the destructive effects the reprint set will have on prices. But I think it all boils down to print run. I’m confident that Wizards of the Coast could print significantly more MM2015 than they printed MMA and the demand would still be high enough to keep aftermarket prices at or above MSRP. If this is the case, then perhaps the demand will truly keep singles prices afloat.

Most likely, the high chase cards and Mythic Rares will again see a significantly less impact on prices, while casual cards / less in-demand cards are more likely to take a hit.

And then…two years later if Magic continues to grow and Modern remains popular then maybe prices all recover yet again. We’re paving some new ground here, and it’ll definitely be interesting to watch things unfold. All we can do is weigh risks/rewards and allocate our funds accordingly!

Thanks for commenting,

Sig

Welcome aboard!

I recently had a daughter, but my wife and I are fortunate in that we do have a fair amount of disposable income… I’m also a gambler and therefore a risk taker, but I prefer to take calculated risks and your article helped me to realize that I just need to get out when I have made the profit and continue to diversify as I have started to do.

Thanks for the great read!

Thanks a lot for the compliment, Ben! Glad you enjoyed the article.

I certainly have my fair share of risk exposure, don’t get me wrong. But most of it is in the form of stocks. When it comes to MTG Finance, I don’t want to be losing money when there are so many profitable opportunities. So it’s natural for me to be more selective. And as you pointed out, I’m always eager to take my gains! If you’re up nicely on an investment, think to yourself “would you really want to buy more at the current price?”. If the answer is “no”, then you should probably sell. Because you could have that cash to put into stuff you WOULD be willing to buy.

Let’s continue to dialogue – perhaps you can keep me in check and ensure I’m not being TOO risk averse 🙂

Thanks again,

Sig

Great article!, I’m looking forward on reading more from you 🙂

Thank you very much!!! 🙂 I look forward to writing every week and I hope you continue to enjoy what I have to share. I’m always open to feedback – both positive and constructive! Without your comments, I’ll have no idea if I’m sharing insightful thoughts or if I’m way off the mark.

Talk to you again soon!

Sig

Greetings from Poland

Very good article, thankYou. Few things mentioned here i just “feeled” and now I know why it is so.

ps. it is nice to know that many people with very young children keep playing and trading

Regards

Janusz

proud dad of 2 month Sophie

Janusz,

Wow, congratulations on your baby girl! How you sleeping? 😉 I remember when my son was 2 months, we were up every 3-4 hours for feeding after feeding after feeding. Talk about a trying time!

It’s amazing how much the Magic player population has aged along with the game. I believe that is also merit for another article topic someday, because I believe older players have access to more income (on average) and therefore can afford all those nostalgic cards they love (Dual Lands, stuff like Moat and Tabernacle, etc.). Just a theory – I’ll think some more on it before writing up a piece in the future.

Thanks again for the comment! And by the way, my grandfather (father’s father) is from Poland! 🙂

Talk to you again soon,

Sig

Really glad to see you writing here and I enjoyed this piece.

I think the advice “if you don’t want to buy more at this price maybe you should sell” is something I will really think about.

I like it.

Also an MTG dad which does put a dampener on playing ambitions but there is more to Magic than just winning the pro tour 🙂

I’m happy to be here, and hopefully I’ll be able to reach a broader audience with my writing now.

I’ll confess the concept of “every day you don’t sell is a day you’re choosing to buy” isn’t completely my own. I may have been the first to apply this to Magic, but I read about this thought-process in its application to the stock market a long time ago. It may have been Warren Buffet, though I can’t confirm that. But essentially that was the thought process: if you are not willing to buy more of a stock at a given price, then you really shouldn’t be holding it to begin with. Something like that. It may not apply 100% directly, but there’s definitely a nugget there worth exploring.

Glad to see I’m not the only MTG dad trying to stay actively involved in the community via Finance. Playing in competitive events takes a ton of time, but buying and selling a few cards now and again can be done on my own time!

Thanks for commenting, looking forward to hearing your thoughts on my future articles!

Sig

Excellent article! I really appreciate your advice on diversification and offsetting the risk of reprints. I was a big fan of your work on QS. Question for you – do you use Pucatrade at all? I find the platform really good and you can pick up some cards quite cheap, but it seems a little tricky to take advantage of changing finance conditions (at least, compared to a store) given that you can’t lock in a price when it goes on your want list.

Cameron,

Thank you! Glad the article was interesting, and glad you also enjoyed my work at QS. I plan on continuing to churn out high quality weekly articles here at mtgprice now, and definitely appreciate all my readers!

Pucatrade Pucatrade Pucatrade…I thought it would be a fad and it’s really blown up into a significant entity. I’ve never used it before, but the likelihood I give it a try increases with each passing day. What are your experiences with it? Should I give it a try? I am paranoid about people claiming cards never arrived, or people sending me cards in poor condition, or an array of other unlikely scenarios. Mostly, I don’t like having to send first in order to build up a bank of “points” and then the ensuing wait for people to send me stuff. What was this startup process like?

Maybe it’s time I give it a go…if anything, it’ll definitely inspire a few more articles!

Thanks again,

Sig

Hi Sig,

I haven’t actually used it to send out cards yet – only just to purchase (I bought Pucapoints using Paypal). I’ve bought a bunch of straightforward specs like shocklands and Khans fetches and found it pretty convenient because you don’t have to pay for shipping and the seller doesn’t get their Points until you receive the cards.

However, I think its utility for buying specs is constrained by the fact that:

1. When cards go on your want list, you have to wait for someone to send them to you; and

2. You can’t ‘lock in’ the price – ie if its spiking quickly then you can’t make sure the trade happens before the price rises significantly.

A good example of this is with Dragonlord Ojutai – I tried to get in before his price spiked over last weekend but there were too many people trying to get a copy and very few people willing to trade it off – so I didn’t put it on my want list because I was worried about paying the spiked price.

With respect to selling, I think it has potential in that:

1. No spread – the buy price equals the sell price

2. Very easy to use the pucapoint you get in return to buy up staples like shocks.

However, the downside it that it can be very difficult to trade away standard cards you want to divest. For example, I’m trying to move my Thassas and MOWs but no-one on pucatrade seems to want them.

I hope that helps!

Cam

Cam,

This is definitely helpful, and confirms some of my reservations. It must be a bit tricky unloading expensive, obscure cards to some degree too. Though the approach of buying points is interesting. Do you find the savings on shipping is real, or just blended in with the numbers?

Sig

One of my favorite writers and a good guy in general – followed you over and look forward to your new content here, amongst others.

Thanks for following, Jason! I really appreciate it as I know it’s a bit of a change. 🙂 I plan on sticking to the same weekly schedule here. Don’t forget to visit the forums if you decide to sign up for the Pro Trader account!