By James Chillcott (@MTGCritic)

Recently I’ve found myself being pulled into cyclical debates on the ethics of MTGFinance. With the increasing participation and interest in this side of the Magic: The Gathering community, it seems like a good time to get to the bottom of things.

The Price Is Always Right

So the other day I’m at a new nerd conference in Toronto and I notice halfway through day 2 as we’re promoting ShelfLife.net (plug: our next gen social commerce platform for collectors) that attendance is pretty dismal. Figuring the vendors may be in the mood for deals I locate an LGS dealer with a ton of binders in tow and no central pricing system. This is exactly the scenario where you are likely to find the best, and the largest deals, largely because only the biggest most dedicated vendors can possibly keep up with the increasingly rapid prices shifts in our community. Sure enough I locate over $2500usd in singles within 30min of binder browsing. I stack the cards in piles at various price points, the dealer signs off on a $1100cdn sale price after some haggling down from $1400cdn and we conclude our business with a handshake and a smile.

Now pause and ask yourself: did I rip him off? Or more to the point, was the transaction ethical?

I assert that it most certainly was, and here’s why:

1) No one was lying, causing distractions, fast talking or otherwise obscuring the action

2) We’re responsible adults responsible for our own decisions, and his decision was to publicly offer the products in question at the prices we both agreed to

3) Interest is the first sign of market shifts, and he waved it off, likely because;

4) He clearly saw value in the cash flow

Now let’s examine what could have happened had I chosen the opposite path, a path some people might demand I take to achieve perfect transparency. I could have, for instance, tallied the cards, and engaged in this conversation:

- Me: I think these cards are worth essentially double what you have them priced at, about $2500.

- Vendor: Thanks! My new price is $2500. So would you like to buy them at that price?

- Me: No thanks.

- Vendor: Oh, why not? Don’t you recognize them as being worth this price on average in the market?

- Me: Yes.

- Vendor: So then you’re backing out because you can get them somewhere else cheaper?

- Me: No, I’m backing out because I believe these magic cards are investments, and as such, must operate under the principle of opportunity costs.

- Vendor: How’s that?

- Me: Because you’ve reset the price to market average, there are now other options I believe will yield better returns within the same time frame, and my role as a market maker dictates that to achieve an efficient market I must act logically and efficiently and pursue my goals while you pursue yours. When the value of my potential returns matches your value in cash flow, a market action will occur and we will both be equally happy. In this particular case I have clearly spent a lot more time than you tracking and memorizing current price averages. This knowledge has value, and I just conferred that value to you as a gift, creating an imbalance in our market making potential and ensuring we cannot achieve market action. You see, I came to your booth loaded with efficiency, free cash flow and risk taking potential. You were carrying inefficiency, low cash flow and lower risk potential, as expressed by your willingness at any time to convert cards that could potentially accelerate in value for cash that averages a much lower interest rate unless reinvested in greater prospects. This insinuated that any (or all) of the following was true:

a) your time was too valuable to make re-pricing your inventory to match current demand worthwhile

b) your potential reinvestment opportunities exceeded my perceived net present value of the cards in question

Further, our lack of prior exchange of social value through camaraderie, emotional support or familial ties makes my donation of value result in an unequal match. I’ve sacrificed over $1000 in value for no discernable benefit as other market actors were already willing to sell me these cards at the newly requested price, which I’ve only just now made you aware of. As such instead of heading home with $1100 cash, you’re heading home with $600 in booth fees, time wasted and no opportunity to reinvest. I’m heading home with $1400 less profit potential at a risk level previously determined to be acceptable, and a non-friend I’ve donated goodwill to without any return on my investment.

Final score: No one is winning. The market is broken.

StarCityGames Is Not The Market Price

So having taken a closer look at the dynamics and difficulties of trying to manually price thousands of magic cards, let’s examine where these kind of scenarios have led the LGS/Vendor segment of our hobby ecosystem.

Back in the pre-internet days, Inquest and Scrye magazine published monthly with card pricing lists taken from surveys of selected vendors around North America. This system led to many golden opportunities for savvy players who could spot a rising tide for certain cards at the tournament level and translate that into smart actions at their local gaming stores before the new issues came out the following month. It also tended to result in highly specialized local economies, with card pricing varying oddly from community to community based on local play styles, format focuses and house rules.

The advent of the Internet, and in particular the ability to view past transactions on Ebay yanked us all into an entirely new era, with easy access to global price data, a trend that has only accelerated in the last 5 years with big data sites like MTGPrice.com, MTGOGoldfish.com, mtgowikiprice.com and TCGPlayer.com. Better information, made widely available should be good for everyone but coupled with the rise of the smartphone has empowered players to take advantage of low margin (aka inefficient) vendors, as well as lazy players, who can’t keep up with pricing shifts. (Now to be fair, vendors have done this to players since the beginning, using buy list tactics that most would consider normal business.)

At the same time, the tendency for commerce to centralize within niches online, leads to the appearance of major market actors with high efficiency such as StarCityGames.com. SCG brand equity then leads to their price lists being used as a mutually agreeable reference point for market actors seeking to equalize value and achieve market action. Other vendors then go a step further, seeking to achieve efficiency and close more market actions through the simplest course of action: copying SCG pricing.

This has lead us to entirely new era of Magic pricing: The Age of Oligopolistic Tendencies.

As opposed to a monopoly which is typically defined as a single market actor holding unfair stores of value due to legal, procedural, resource access or other major advantages, an oligopoly is typically characterized by a relatively few market actors disguising their inefficiency by agreeing to fixed pricing that ensures certain margins and leads to permanently unequal value exchanges while maintaining a relatively stable model of market sharing for the vendors. These situations are especially exacerbated in the case of goods essential to living such as food, warmth, clothing and shelter. Though no true oligopolistic cabal exists in the MTG world, the tendency of inefficient vendors to leverage platforms like Crystal Commerce to track and average the prices of the largest vendors to set their own pricing, is leading us towards a magic ecology with oligopolistic tendencies. (It’s worth noting here that between TCGPlayer, Ebay and PucaTrade “true” market pricing is still widely available and in play.)

Put simply: If everyone uses the same pricing, originally set by the most efficient vendor, no actor will ever be able to achieve further efficiency or recognize the true value of their potential market actions. This is true because in theory and practice, the scenario for every market actor is unique, and their price should be uniquely customized to that scenario.

Eg) Store X has $2500 (SCG pricing) in singles for sale. They set their price on this pile of cards to $2500. A player enters the premises and offers $2300, and the LGS declines because Crystal Commerce says their price is on target. The problem here is that price comparisons only establish the cash value of a transaction, and utterly fail to establish the other forms of value and opportunity cost. For instance if Store X can achieve higher inventory turnover rates, lower overhead, lower product costs, enjoys different tax scenarios, or any number of other value stores, they may be economically incorrect to turn down the deal.

This is a key concept, so let’s dig deeper. Check out this table of value store calculations on a theoretical booster box of Conspiracy being sold by an LGS with greater efficiencies than SCG, but priced to match on the premise that SCG is using the “correct” price:

| LGS X | StarCityGames | |

| Product Cost to Vendor | $74 | $72 |

| Posted Sale Price | $99.50 | $99.50 |

| Turnover Rate (Days to Retrieve Capital) | 180 | 216 |

| Investment Periods/Annum | 2.027 | 1.689 |

| Corporate Tax Rate | 15% | 35% |

| Overhead/Box/Days to Turnover | $3.50 | $7 |

| Gross Yield%Gross Yield

Yield Net Overhead %Yield Net Overhead Yield After Tax Effective Annual Yield After Tax**r = (1+i)^ |

$25.50/box34.45%

$22/box 29.72% 25.27% |

$27.5038.19%

$20.50 28.47% 18.50% |

So what exactly does that math demonstrate?

Well, in essence it demonstrates that an LGS with access to non-revenue value stores can achieve greater return on investment than a major market actor. In reality, some of these stores are quite possible (better tax scenarios) while others (think overhead/box sold) are highly unlikely due to economies of scale and scope. Even still, assuming we accept that an LGS could achieve more efficient capital returns, why does that matter?

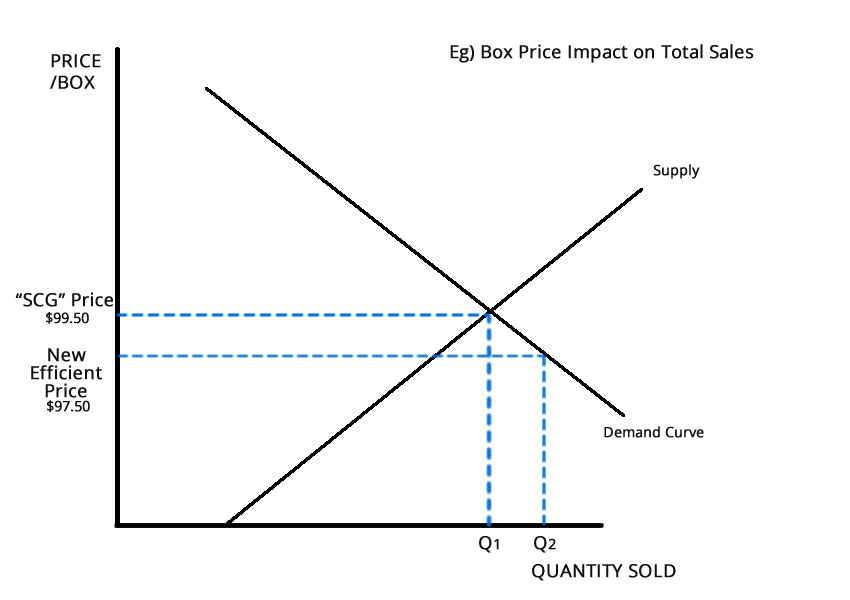

It matters because higher yield would allow them to lower box prices on the premise that lowering prices below SCG pricing would increase overall sales, and because we already know the LGS has superior returns on those sales, they can make more money overall by undercutting their larger competitor. Here’s the kind of graph we’re talking about.

Note that the demand curve shifts out when the price drops, resulting in higher overall sales, because, duh, more players will buy more boxes if they’re cheaper.

Here’s some more math on the two possible scenarios (for illustration only, since just how much demand may increase based on lowered pricing depends on many factors beyond the ken of this discussion). We’ll even assume lowered box costs as volume increases, though the plateaus would be fairly broad in our ecosystem:

| Cost/Box | Revenue/Box | Boxes Sold | Total Profit | |

| Scenario A: SCG Price Match | $74 | $99.50 | 186 | $4743 |

| Scenario B: Set Lower Price | $73 | $97.50 | 223 | $5463.50 |

The LGS has dropped their price slightly, increased sales by about 20% and achieved a slight inventory cost reduction as reward for their higher volume (because they contributed to their wholesalers own inventory turnover rate), leading to an overall increase of 15%.

Surprised? You shouldn’t be, because this is EXACTLY what a properly functioning free market economy is supposed to look like. A healthy economy needs the friction of market actors jostling for position to trend towards the most efficient combination of price and alternate value that maximizes both shareholder return for the companies and utility for the consumers.

Note that this is functionally identical to my trip to the LGS with noticeably lower prices because in encountering that actor I had no way to know whether they were:

a) seeking value through inaction (due to the value of their time)

or

b) deliberately lowering prices to increase inventory sell through and capture more market share.

The real point however, is that it just doesn’t matter why they were priced lower because whether their price positioning was intentional, representative of alternate value stores or representative of their inefficiency, the market needs the match tested to find equilibrium. If the match is efficient, I will return, repeat similar transactions and the vendor will thrive if their choices are in fact efficient, applying competitive pressures to SCG and other larger market actors to lower prices for more and more players. If it is inefficient, I may one day return to find the vendor closed, and I will move on to market matches with the most efficient vendor I can find, and the cycle continues. I mean I miss those Friday night hunts for value at Blockbuster, but I can’t argue that the shift from $30 in late fees/month to $10 unlimited access to content from my couch via Netflix isn’t the purest representation of market evolution in motion.

The Boundaries of Ethical Trading

First off, I’m a long standing liberal. In fact, up here in Canada, we have parties further left than the Democrats and I vote them with pride. Ultimately I consider myself a social pragmatist, but I reserve the right to skew the energy I spend on socially conscious commerce in favor of essential rather than non-essential goods. That means I tend to transfer value to causes that are improving the overall standard of living more efficiently than I ever could directly. As MTG is an upper middle class game with no essential utility, I am definitely on the side of economics vs. social good, but only so far as I believe they are in fact one in the same in terms of achieving market efficiency in the Magic commons. By this I mean that good economics will lead to the healthiest overall community, a fact I’m sure Hasbro drills into the WOTC exec at every opportunity.

Remember a few years back when they yanked global tournament support, ditched the old rating system and abandoned nationals? We all yelled a lot, but the game has only gotten better since, presumably because the internal reallocation of resources has made the entire operation more efficient at attracting users and increased the overall utility to our community broadly despite the painful transition.

Further, there is a huge difference between accepting a listed price, and engaging in more nefarious acts. Here’s some scenarios I DON’T support:

- Duping kids is off limits, simply because they aren’t legal market actors at all and cannot be expected to act rationally.

- Noobs are off limits, largely because being kind to new players yields social scenarios that largely outweigh any meager profits that could be made off their single copy of Jace. I’m not above dumping 1000 commons on someone in a swap for a $50 rare, but I always make sure they know the score, and they’re rarely concerned since variety > power in the early days of trading.

- Switching price tags, confusing vendors when busy, lying about condition, delaying payments and failing to honor posted prices (a personal pet peeve) are all forms of theft because they represent non-voluntary transfers of value.

In the end, I’ve written this article to make one simple point: you are no more responsible to “correct” the pricing of a vendor than they are to “correct” their pricing when you need a Snapcaster Mage ten minutes before the start of the GP.

I’m also asserting that such acts of price adjustment, are in facts acts of economic and/or social charity, resulting in the transference of hard earned value from one market actor to another without justification. And while you may feel good about doing it, you may in fact be injuring the health of the MTG economy as a whole by failing to exert the pressures that lead to maximum market efficiency and the lowest possible price for playing this beautiful game.

Now you may say “hey, wait a minute, I hang out at my LGS every day, I’ve known the owner for years and I need to look him in the eye when we trade. This guy gives me deals, runs a good scene and he’s always got snacks on hand for Commander night.”

My response is that you and the owner are not simple market actors, but something closer to friends (or at least peers), in your scenario, and are by definition engaged in a barter economy where you trade value in terms other than just cash, and in doing so you keep things just as equal as if you had bought him out of a common box worth of Simian Spirit Guides. When you notify him every time his pricing seems low, you are in essence investing the value of your knowledge into your favorite hangout and inevitably expecting that value to yield dividends. You may consider yourself the altruistic sort, but when push comes to shove, if you save him from buyout after buyout and he won’t even put aside a Conspiracy box for you, you are unlikely to continue the exchange.

To wit, nor should you.

James Chillcott is the CEO of ShelfLife.net, The Future of Collecting, Senior Partner at Advoca, a designer, adventurer, toy fanatic and an avid Magic player and collector since 1994.

Track your collection's value over time, see which cards moved the most, track wishlists, tradelists and more. Sign up at MTGPrice.com - it's free!